U.S. Paper Money, 1793-Present

America's currency has seen a number of changes since it began in 1793. One of the biggest was the introduction of paper money at the start of the Civil War. From bank-issued pieces to notes issued by the Federal Reserve, collectors love U.S. paper money!

The birth of America's currency system – 1793

Once the Constitution was ratified, the coinage system of the United States was established. America's first coins were struck in 1793 at the Philadelphia Mint, and from then until 1861 (68 years later), the U.S. government saw no need for a national paper currency.

But during this period, several important events took place. The War of 1812, the Mexican War of 1846, the Panic of 1857, and the uneasy period immediately before the outbreak of the Civil War all caused a severe drain on the U.S. Treasury. To overcome these deficits, the federal government issued so-called Treasury Notes from time to time. They were simply signed "promissory notes" which earned interest, and did not circulate as money except for a brief time in 1815.

Financial ruin and "broken banks" – 1830s-1861

Despite such difficult economic periods, the country continued to grow. It became apparent that there simply was not enough money in circulation to meet the ever-increasing needs of daily commerce. In an effort to remedy the situation, some states gave private banks the right to issue their own currency. The backing for this currency was the amount of money the bank had on deposit.

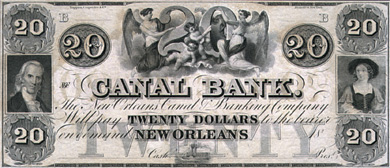

Broken Bank Notes often showcase artistic designs.

Unfortunately, when times were hard, people failed to pay their loans, and banks lost their source of income. Without money coming in, banks literally "went broke" and were forced to close their doors.

The currency issued by these ruined banks became known as "Broken Bank Notes." Because of their wide range of artistic designs, unusual denominations, and the oftentimes colorful names of the banks themselves, these notes are popular collectibles today!

The Civil War – 1861-1865

The Civil War had a great impact on America's paper money. Due to the duration of the conflict, financing the war became a major problem. Supplies, clothing, and pay for the military had to come from somewhere. And it wasn't long before the United States found itself in a desperate financial situation. Remedies included increasing the national debt, enacting the first income tax, and issuing a national paper currency.

Putting their faith in paper money

Congress finally passed the Act of July 17, 1861, which permitted the Treasury Department to print and circulate money. "Specie" payments were suspended, which meant the new paper money could not be converted into either silver or gold coins.

The first $5 Legal Tender Note, dating from the Civil War. Alexander Hamilton and a statue symbolizing Freedom are featured.

The public was expected to accept this money purely on faith that it would be good. People did use the currency. But the mounting costs of fighting the Civil War, and the uncertain financial position of the North cheapened the paper dollar so much that circulating copper, silver and gold coins were hoarded and almost disappeared completely!

The first United States notes of 1861 are known as Demand Notes, and in 1862 they were replaced by Legal Tender Notes. From the first U.S. paper money issued in 1861 through to the present day, all paper currency issued by the U.S. government has remained legal tender!

Jefferson Davis, president of the Confederate States of America

Confederate Currency 1861‑1865

On February 9, 1861, the Confederate States of America established a provisional government with its capitol in the city of Montgomery, Alabama. Jefferson Davis was elected president.

Five days after Louisiana seceded from the Union, her state troops seized the United States Branch Mint and Custom House at New Orleans. The Congress of the Confederate States resolved that the mints at New Orleans and Dahlonega, Georgia should be continued – striking U.S. coins dated 1861, though now under Confederate supervision.

Once the Confederate government was fully established, it resolved to solve its financial woes by issuing its own paper currency. Southerners were asked to accept it on a par with regular money or bank notes – enabling it to perform the functions of legal tender. Eventually, as the war dragged on and continued to drain the South's finances, it was patriotism alone that gave the Confederate currency any value.

The South battles inflation

The expenses of the Confederate States of America continued to increase, and as the war went on, Southern currency continued to depreciate in value. Confederate president Jefferson Davis's wife kept a diary of those trying days in the South. Paper money in denominations of $5 and under was useless. The Confederate money supply was so inflated it could buy little. Mrs. Davis recalled that turkeys sold for $60 each, tea was $22 a pound, and milk was $4 a quart. One bar of soap could sell for as high as $50, and an ordinary suit of clothes cost $2,700! In spite of the inflation, the Confederate Congress continued to issue millions of dollars worth of notes.

As the Civil War progressed, inflation in the South reached such a high level that it took as many as five of these $10 notes to buy one bar of soap!

At the time of the war's conclusion, the currency authorized by the Confederate Congress consisted of hundreds of varieties. Several states of the Confederacy (Georgia and North Carolina, in particular) issued their own money, too. As true mementos of the Civil War, genuine Confederate currency is hard to beat!

The North's war chest runs low

While the Civil War was in progress, Lincoln's administration needed increasing sums of money to wage the war. The nation lacked a central banking authority, and was relying largely on private banks – banks whose finances were not always sound.

In 1863, the National Banking Act passed. This act created more money with which to fight the war. It also attempted to regulate the country's chaotic currency system. The new act encouraged private banks to apply for federal charters, thereby making them "national banks."

National Banks to the rescue – 1863

Newly chartered "national banks" used their funds to buy Union bonds (thus raising money for the war). They deposited the bonds with the Treasury in Washington, D.C., and then were allowed to issue National Bank Notes for up to 90% of the value of the bonds on deposit.

The National Banking Act created certain advantages both for the government and former private banks. The government received cash and started a federal banking system capable of regulating banking activity. And private banks that "went national" commanded more respect and trust than those that failed to take advantage of the federal charters.

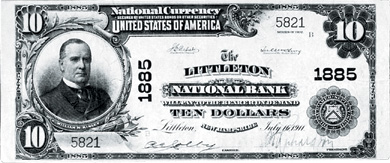

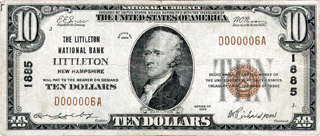

National Bank Notes offer collectors a tremendous variety. Here are examples of large-size (above) and small-size (below) notes from the Littleton National Bank.

During the act's first year, 179 banks went national. By the end of the Civil War (in 1865), the number was nearly 2,000. When the last bank notes came off the presses in 1935, over 14,000 banks had become members! All of them issued paper money with their own name on it, and all is still legal tender today.

Franklin D. Roosevelt

A new era begins

At the start of the Great Depression (1929), many banks began to fail. In 1933, newly elected President Franklin D. Roosevelt declared a "banking holiday," and ordered the U.S. banks closed. The system was closely examined. It was determined that the National Bank Note System was outdated, inflexible, and not equipped to manage the nation's finances in depression. Roosevelt's administration put faith in the new Federal Reserve System, and National Bank Notes became obsolete.

However, the sheer extent of varieties, including the number of banks that issued them, the different signatures of local bank officials, and the towns where these banks were located all serve to make National Bank Notes a popular collector favorite.

Today's "small-size" or "modern" notes are direct descendents of all of the influential people and historic events that contributed to the development of our nation's paper money. America's currency continues to evolve, and new collecting opportunities are created all the time! Now is a great time to explore this exciting and satisfying hobby by building your own paper money collection!

See all of the U.S. notes available in our U.S. Paper Money inventory.